Home Improvements That Increase Value 2024 Tax – The easiest way to claim a home-office tax break is by using the standard home-office deduction, which is based on $5 per square foot used for business up to 300 square feet. The “regular method” for . Major home renovations that don’t qualify for these specific tax savings may still be helpful when you sell your property. Per the IRS, “improvements add to the value of your home, prolong its .

Home Improvements That Increase Value 2024 Tax

Source : www.marketwatch.comNews Flash • Durham, NC • CivicEngage

Source : www.durhamnc.govMassachusetts Solar Incentives, Tax Credits And Rebates Of 2024

Source : www.forbes.comTeam KG | Anchorage AK

Source : www.facebook.comOhio Solar Incentives, Tax Credits And Rebates Of 2024 – Forbes Home

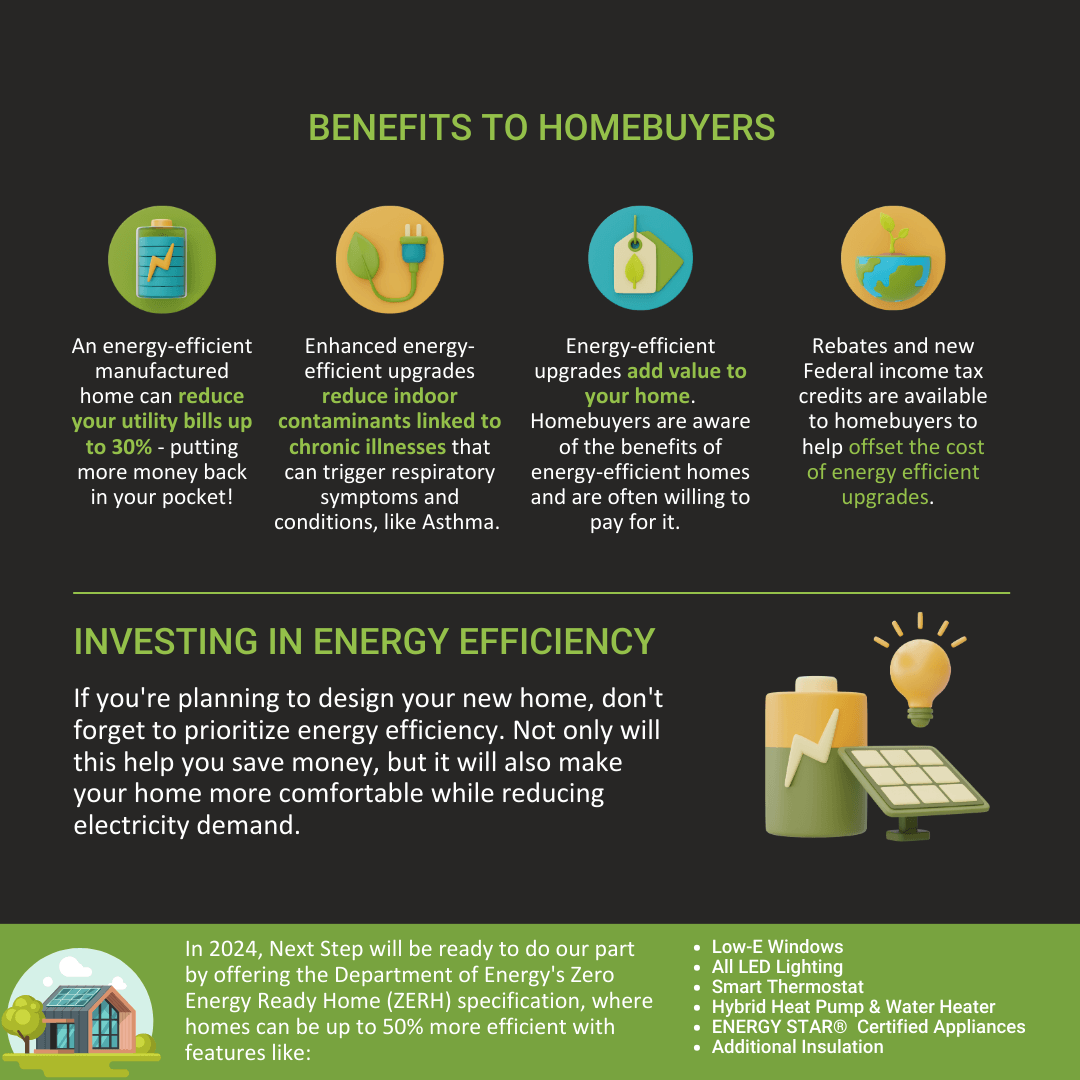

Source : www.forbes.comThings to Know About Energy Efficient Manufactured Homes Next Step

Source : nextstepus.orgSolar Tax Credit By State 2024 – Forbes Home

Source : www.forbes.comHoover project stalled, North Canton pushes Maple Street Commerce

Source : www.cantonrep.comFlorida Solar Tax Credits, Incentives and Rebates (February 2024)

Source : www.marketwatch.comFlorida Solar Incentives, Tax Credits And Rebates Of 2024 – Forbes

Source : www.forbes.comHome Improvements That Increase Value 2024 Tax Do Solar Panels Increase Home Value? (2024 Guide): A home with energy-efficient features can see an increase in its value by as much as 8%. Read More: How Big Will the Average Social Security Check Be for Retirees in 2024? Estimated return on . Your 2024 appraisal is supposed to reflect your home’s current market value. A higher value means higher taxes. You can fight it, and we’ll show you how. .

]]>